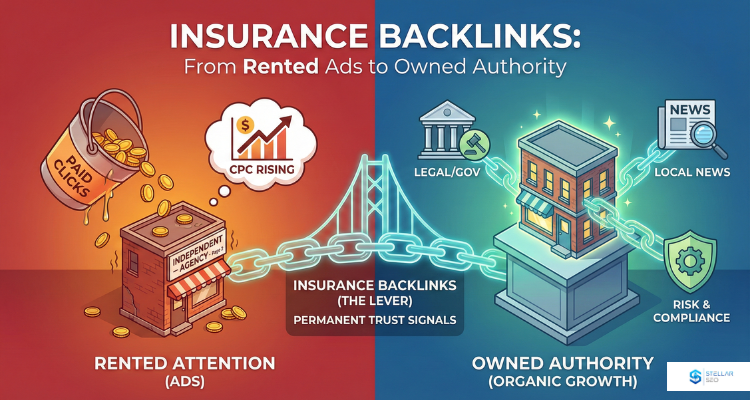

Stop Overpaying for Clicks and Win Organic Authority

This article is written for independent insurance agencies and regional brokerages that are stuck on page two, watching CPCs climb while organic growth stalls. This applies most directly to single-location and multi-location agencies competing in metro areas where national carriers dominate paid placements.

If you are spending aggressively on Google Ads for car insurance, commercial policies, or bundled coverage and still fighting for visibility, the issue is a lack of authority and entity-aligned trust signals.

Stellar SEO builds insurance backlinks for ambitious agencies that are tired of being stuck, using patterns we see repeatedly across competitive metro and regional markets.

The Real Problem Facing the Insurance Market

The insurance market is one of the most expensive digital environments in search. Paid acquisition costs continue to rise, especially for local searches tied to high-intent terms. Many insurance companies respond by increasing ad spend instead of fixing the underlying issue.

For most insurance agencies, the gap is not content volume or design, but rather a weak backlink profile that fails to validate expertise within the insurance sector.

Why Backlinks Behave Differently in the Insurance Industry

The insurance industry sits squarely inside Google’s trust-sensitive categories. Insurance SEO is evaluated more harshly than many other verticals because the consequences of misinformation are high.

A search engine looks for confirmation that an insurance website is referenced by credible third parties who understand risk, claims, coverage, and regulation. This is why links from generic blogs rarely move the needle, even when their metrics look strong.

A mention from a professional legal or risk-focused publication discussing claims disputes carries more weight than a general finance article. That link demonstrates real-world overlap with how insurance actually operates. In practice, these links tend to index faster, hold value longer, and correlate more closely with movement in competitive service keywords.

What “High Quality” Means for Insurance Backlinks

High quality backlinks are not defined by domain authority alone. In the insurance niche, quality is determined by context, relevance, and placement.

A link earns weight when it meets all three conditions:

- It comes from high authority sites that publish actively

- It appears inside content related to insurance, risk, compliance, or claims

- It points to a linked page that reinforces service-level expertise

Quality backlinks like this improve keyword rankings and stabilize SEO performance across competitive terms.

Strategic Link Building for Insurance Websites

Link building only works when it is intentional. Strategic link building aligns placements with revenue-driving pages, not random blog posts.

Every insurance website should know which pages matter most for SEO growth before outreach begins. That includes service pages, location pages, and resources designed to convert potential clients.

We commonly see agencies sending links to blog posts while their service and location pages remain underpowered.

A Link-Worthy Asset That Actually Works for Insurance Agencies

Instead of publishing generic blog content, create something publishers can cite.

One proven example:

A state-by-state liability limit reference for small businesses or contractors. This type of resource is frequently referenced by local news, business associations, and authority websites covering compliance or risk management.

Assets like this earn high authority links naturally, without aggressive outreach or forced guest posts.

The Monday Morning Insurance Backlink Checklist

Before building new links, fix what already exists.

- Review your backlink profile for outdated scholarship links from prior campaigns. These are now low-trust signals for insurance websites.

- Identify whether at least 15 percent of your referring domains are locally relevant. Local news, chambers, and regional publications consistently outperform national directories.

- Check anchor text distribution. Overuse of commercial anchors suppresses seo performance in insurance.

These checks take less than an hour and often unlock stalled seo growth.

Low-Value vs High-Value Insurance Links

| Link Type | Why It Fails or Wins |

|---|---|

| Generic directories | Ignored by search engines in the insurance sector |

| Guest posts on unrelated blogs | Lacks topical relevance and user intent |

| Authority websites discussing risk or claims | Reinforce real insurance expertise |

| Local publications | Strengthen local seo and local visibility |

| Active niche content | Supports long-term search visibility |

This distinction is where most insurance brokers fall behind competitors.

Professional Link Building Services vs DIY Outreach

Most agencies underestimate the complexity of insurance link building. Outreach failure rates are high, editorial standards are strict, and mistakes compound quickly.

Professional link building services succeed because they already understand which placements move search rankings and which ones do nothing. SEO experts also control anchor text usage and placement context, reducing volatility while increasing seo success.

This is about precision and consistent effort.

How Insurance Backlinks Drive Organic Traffic and Qualified Leads

As relevant referring domains accumulate, search visibility improves. Rankings stabilize. Organic traffic increases.

More importantly, the traffic converts.

When links support the right pages and align with user intent, insurance agencies see gains in qualified leads rather than empty visits. This is where seo strategy becomes a business asset, not a marketing expense.

Local SEO Signals That Multiply Link Impact

Backlinks work best when paired with strong local seo strategies.

An optimized Google Business Profile, consistent NAP data, strong Google reviews, and accurate meta descriptions amplify link value. Together, these signals improve local searches and drive local visibility for insurance agencies competing in tight geographic markets.

The Counter-Intuitive Truth About Insurance Links

Many agencies chase .edu links. In practice, these often deliver zero ranking lift, especially since most link builders offer links on EDU subdomains instead of the root domain.

Links embedded inside active articles about risk management, claims litigation, or compliance outperform most academic links. Context beats prestige every time.

A Clear Next Step for Agencies Stuck on Page Two

If your insurance agency cannot rank higher for core services, start here:

Run a competitor gap analysis using a tool like Ahrefs or Semrush. Look specifically for ‘Intersecting Domains’ where your top three competitors have a link, but you do not. Prioritize domains that link to multiple competitors and publish insurance-adjacent content. This is your immediate hit list for outreach.

If you’d rather have it done for you, get in touch to learn how our link building services can help you expedite the growth process and skip the learning curve.

FAQs

How long does it take to see ranking improvements from new backlinks?

Most insurance agencies see measurable movement in three to six months. SEO is a compounding process. You will often see rankings for “long-tail” or specific policy keywords improve first, followed by more competitive terms as your overall authority grows.

How many backlinks does my agency actually need to rank?

There is no universal number. Your requirement is defined by the “link gap” between you and your top three competitors. If the top-ranking agency in your city has 50 high-quality referring domains and you have 10, your goal is to bridge that gap with better quality placements.

Are guest posts still a safe way to build an authoritative presence?

Yes, if the site is relevant to insurance, finance, or risk management. Safety issues only arise when you use generic “link farm” sites that publish content on unrelated topics. High-quality guest posts on industry-adjacent blogs are a staple of successful insurance SEO.

Do I need new links every month?

Consistency is a trust signal. A sudden surge of links followed by months of inactivity looks unnatural to search engines. A steady, monthly acquisition of high-quality links proves to Google that your agency is a growing, active authority in the market.

Should I link to my homepage or my quote tool?

Links to quote tools often have high bounce rates when users aren’t ready to proceed. We find that linking to educational ‘Decision-Stage’ content (e.g., ‘How much coverage do I actually need?’) earns more links and warms up the lead better than a direct link to a quote form.

Related Guides