What Is Financial Services SEO?

Financial services search engine optimization (SEO) is a marketing strategy that increases the digital presence and organic traffic for businesses in the financial sector.

SEO campaigns can benefit most financial services companies, including insurance companies, banking institutions, brokerages, lenders, accountants, and tax professionals. The right SEO campaign can also benefit Finserv and fintech companies.

What Are The Benefits of SEO for Finance Companies?

SEO for financial services offers many benefits, including:

- Better brand awareness: Brand awareness and firm authority can help make your financial company a household name, helping to nurture potential clients.

- Increased customer trust: Trust is essential in the financial services industry.

- More targeted leads: SEO for finance companies increases leads and brings more relevant traffic that is more likely to convert.

- Competitive edge: SEO and increased Google search rankings can give financial companies a competitive edge, helping them stand out from other firms.

Decoding SEO for the Financial Services Industry

The financial services industry has unique SEO challenges and opportunities. Unlike other sectors, financial companies operate under stringent regulations, and their websites fall under the YMYL (Your Money Your Life) category due to their potential impact on an individual’s financial stability.

YMYL is a term Google uses to categorize web pages that can potentially impact a person’s finances, health, or safety. Financial websites fall directly into this category and are held to a higher standard.

For this reason, to excel, companies in the financial services sector must exhibit Experience, Expertise, Authoritativeness, and Trustworthiness (E-E-A-T) – the bedrock of SEO for financial websites.

This entails fostering trust, comprehending YMYL, and adhering to compliance in content creation – the foundation of successful SEO campaigns.

Data-Driven Decision-Making in Financial SEO

A data-driven approach is essential to ensure your SEO and content strategy complies with current standards and is competitive.

Tools like Ahrefs will allow you to dive deeply into your competitors’ strategies and tactics. By combining this data with expert analysis from your SEO team, you can identify gaps in your strategy and opportunities for growth. This informed approach allows for adjustments to be made in real time, keeping your website’s content and user experience at the forefront of industry trends.

Google Analytics is a robust tool that offers comprehensive insights into your website’s performance and user behavior. It allows you to track various metrics, including traffic sources, user behavior, and organic traffic. Analyzing this data lets you gain valuable insights into your audience and understand how users interact with your site.

The Pillars of Trust in Finance Digital Marketing

Trust plays a pivotal role in finance digital marketing. Building trust is not just about complying with regulations; it’s about showcasing your expertise and authority in the industry. A financial website with a high level of knowledge in its content and transparency in its dealings will garner trust from potential financial services customers.

Integrating SEO with Overall Digital Marketing

SEO integrates well with other digital marketing strategies, including social media, email marketing, and digital advertising. When included in a strategic online marketing plan, SEO has the power to increase customer trust and boost rankings.

Strategies for Building and Measuring Trust in Financial Marketing

Trust is one of the most important considerations before a potential client enters the financial industry. A variety of strategies can help financial businesses build trust. To begin, a safe and secure data-protected and encrypted website is a must. SEO content and strategy should focus on establishing brand authority rather than selling products.

Leveraging a robust digital presence with ample customer reviews, consistent citations, and high rankings also nurtures potential clients and helps build a trustworthy relationship. Finance blogs should be accurate and offer the reader value. Understanding client needs and concerns can also help bridge the gap between interested readers and clients.

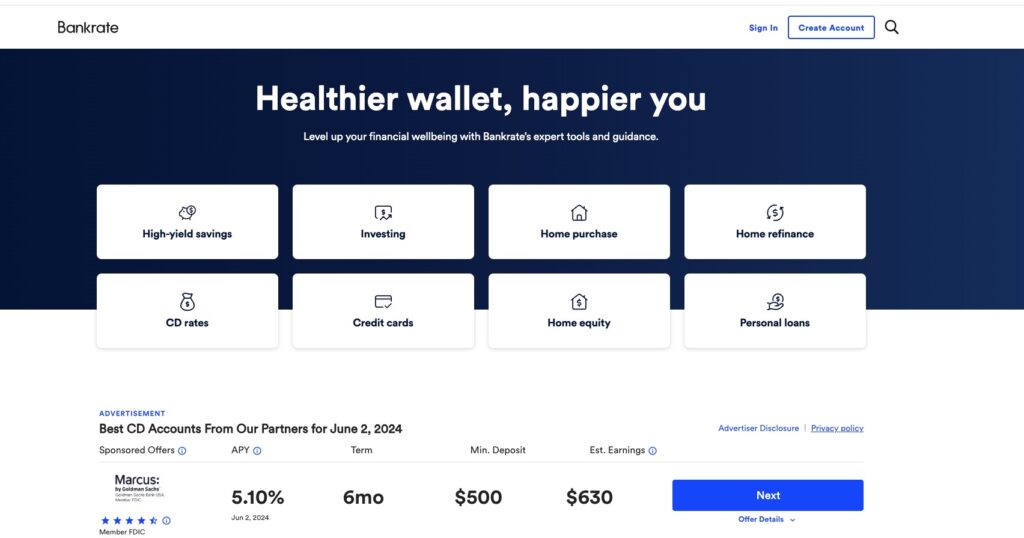

Take Bankrate as an example. Bankrate is one of the most trusted websites in the world, and focusing on a solid reputation contributed to its success. The company began its strategy by focusing on organic traffic and high-quality content before dominating the financial services industry in search and earning a valuation of over $76M.

Ethical SEO Practices

The financial services industry must abide by stringent regulations, making ethical practices essential to your digital marketing strategy. SEO for financial services should integrate white hat, ethical-based strategies to avoid de-ranking or penalties. Prioritizing user-friendly websites and content authority over manipulating search engines leads to long-term benefits.

Navigating Compliance in Content Creation for Financial Services SEO

In the finance industry, compliance is the name of the game. Every aspect of a financial website must comply with industry regulations, from content creation to user interactions. While navigating these compliance requirements may be intricate, it’s indispensable to maintaining trust and credibility.

Collaborating with compliance teams and adhering to guidelines can ensure that your content is engaging and up to the mark from a regulatory standpoint.

Measuring SEO Success in the Finance Sector

Measuring your SEO success is imperative to comprehend the efficacy of your efforts and pinpoint areas that need enhancement. This involves tracking key performance indicators (KPIs), utilizing Google Analytics for in-depth insights, and conducting regular SEO audits.

Emerging Trends in SEO and AI

Staying up-to-date on emerging trends in AI and SEO can also help financial services brands move the needle and produce better results. Voice search optimization, predictable analytics, and AI are the future of technology and help pave the way for better meeting client needs and setting your overall SEO strategy apart from your competitors.

Key Performance Indicators (KPIs) to Watch

Key performance indicators (KPIs) offer quantifiable data, aiding in evaluating your SEO strategy’s effectiveness. For financial services, important KPIs to monitor include:

- Organic visibility

- Keyword rankings

- Organic click-through rate (CTR)

- Conversions

Regular SEO Audits for Continuous Improvement

Frequent SEO audits are essential for keeping up with the ever-changing content marketing landscape. These audits aid in identifying areas of your website that can be optimized for better search engine rankings and user experience. An SEO audit involves evaluating various aspects of your site, including technical SEO, on-page SEO, and off-page SEO.

Crafting a Winning Digital Market Strategy

Achieving SEO success in the finance industry extends beyond comprehending YMYL and fostering trust. A triumphant financial services SEO campaign requires a comprehensive plan that includes target audience analysis, keyword analysis, search intent review, and strategic content planning, all tailored to financial services companies and providers.

Understanding these essential components of an effective content strategy can significantly enhance online visibility and competitiveness.

Target Audience Analysis and Persona Development

Your target audience is the cornerstone of your SEO strategy. Understanding your target customer’s motivations and behaviors can help tailor your content and marketing strategies to address their needs. This involves developing detailed personas that represent your potential clients.

Advanced Keyword Research Techniques

Keyword research is a vital facet of SEO and content marketing. It involves identifying high-volume and relevant terms that your target audience will likely use when searching for various financial services.

Advanced techniques such as semantic, question analysis, and competitor keyword analysis can help you discover phrases that drive traffic to your site and match your services and audience’s search intent.

Strategic Content Planning for Authority Building

Building authority in the financial sector goes hand in hand with strategic content planning. By creating high-quality, relevant content that speaks to the needs and interests of your audience, you can establish yourself as a thought leader in the industry.

This increases your visibility in search engine results and builds credibility and trust with your audience, which is crucial to online success in the finance industry.

Technical SEO: The Backbone of Online Visibility

Technical SEO is a powerhouse for your online visibility, entailing optimization of your website’s technical facets to enhance search engine rankings. To implement SEO effectively, this includes:

Here are some of the most essential components of technical SEO for your financial services company.

Site Architecture and User Experience

A user-friendly, well-designed site is vital for financial institutions’ SEO. Your site architecture should be simple and intuitive, making it easy for users to find the information they want. A well-laid-out website enhances user satisfaction and makes it easier for search engines to crawl and index your site, allowing you to rank higher.

The Importance of Mobile Optimization and Page Speed

In the current digital landscape, a mobile-friendly website is essential. With most internet users accessing websites via mobile devices, financial services firms must ensure their online presence caters to them. Critical aspects of the mobile-friendly design include responsiveness, touch-friendly navigation, and organized media. Mobile optimization involves designing your site so it’s easily navigable, readable, and engaging on smaller screens without the need for zooming or horizontal scrolling.

Prioritizing Page Speed for Enhanced SEO and User Experience

Page speed is a critical factor for both SEO and user experience. Google has clarified that faster-loading pages will rank higher in search results.

Various SEO tools and techniques can help boost page speed, including minimizing HTTP requests, enabling compression, leveraging browser caching, optimizing images, and using a content delivery network (CDN).

Monitoring and Measuring Page Performance

Google’s Core Web Vitals offer a set of metrics that measure the speed, responsiveness, and visual stability of a page. To ensure your website meets these standards, strive for good LCP, FID, and CLS numbers.

Achieving “good” status in Google Search Console for 90% or more of your pages indicates that your site is optimized for these critical metrics, significantly enhancing user experience and potentially improving your SEO rankings.

Ensuring Crawlability and Indexation by Search Engines

Crawlability and indexation are fundamental aspects of technical SEO. Crawlability refers to the ability of search engines to crawl or navigate through your website. Indexation refers to adding web pages to Google’s database.

Making sure that your site is readily crawlable and indexable by search engines is crucial for its visibility in search engine results. Tasks like no-indexing or removing low-value pages, improving internal links, and redirecting URLs with incoming backlinks can help improve your site’s crawlability.

Implementing Regular Audits for Your Finance Company

Conduct regular audits of your website’s mobile-friendliness and page speed to identify areas for improvement. Tools like Google’s Mobile-Friendly Test, PageSpeed Insights, and Lighthouse can provide actionable feedback and benchmarks for your optimization efforts.

By prioritizing mobile optimization and page speed, financial companies can ensure that their website meets the expectations of today’s mobile-first users and stands out in the competitive digital landscape. In return, you should have improved user engagement, higher search rankings, and increased client acquisition and retention.

Local SEO: Capturing the Local Market

Local SEO can be a turning point for your financial services company operating in one or more specific areas. Implementing SEO with local intent enables your business to rank in local search results, helping you reach customers in your target market. Critical factors in the local search include optimizing your Google Business Profile listing and building local citations and reviews.

Claiming Your Google My Business Listing

The first step in leveraging GMB is to claim your business listing. This process involves:

- Verifying Ownership: Ensure that you’re recognized as the legitimate owner of your business to prevent unauthorized changes.

- Providing Accurate Information: To maintain consistency, fill in your business name, address, and phone number (NAP) as they appear on your website and across all online directories.

- Selecting Appropriate Categories: Choose categories that best describe your business to help Google match your firm to relevant searches.

Optimizing Your GMB Profile for Maximum Engagement

Once claimed, the optimization of your GMB listing should focus on several key areas:

- Complete and Accurate Information: Keep all business information up-to-date. Regularly check your hours of operation, especially during holidays, to ensure they reflect your actual business hours.

- Detailed Service Descriptions: Use clear and compelling language in your descriptions with relevant keywords to describe your services. Highlight what sets your financial services apart, such as specialized financial advice, investment strategies, or wealth management expertise.

- High-Quality Images: Upload professional photos of your office, your team, and any relevant imagery that provides a visual insight into your services. Profiles with images tend to have higher engagement rates.

- Ask for Reviews: Encourage satisfied clients to leave positive reviews. Respond professionally to all reviews, address concerns, thank clients for their feedback, and demonstrate your firm’s commitment to client satisfaction.

- Utilize Posts Feature: Use the posts feature to share updates, events, offers, and high-quality content directly on your GMB listing, keeping potential clients informed and engaged.

- Add Q&A Section: Preemptively answer common questions in the Q&A section of your GMB listing.

- Monitor Insights: Use GMB’s insights to track how customers interact with your listing. This data can help refine your local strategy and improve client engagement.

- Implement Messaging: Activate the messaging feature to allow customers to reach out directly through the GMB interface, offering real-time communication.

By thoroughly claiming and optimizing your Google My Business listing, you improve your local rankings and build a more robust bridge between your financial services firm and your community. This strategic approach to local online presence can lead to increased foot traffic, enhanced credibility, and a more substantial client base.

Building Local Citations and Reviews

Local citations and reviews can significantly enhance your online reputation and trustworthiness. Citations are online references to your business, including its name, address, and phone number, while reviews provide social proof of your services.

Building local citations and promoting positive reviews can augment your local efforts and attract more prospective clients.

International SEO for Global Financial Services

International SEO techniques increase traffic to your financial services content from all over the world. Scaling to a global level poses many challenges, including creating and editing quality content in multiple languages, conducting keyword research despite varying search habits, and understanding the cultural nuances of your target market.

With the right finance SEO strategy, though, businesses in the financial service industry can expand their reach and convert international customers.

Link Building for Financial Stability

Link building is an essential aspect of SEO. It requires the acquisition of high-quality backlinks from trustworthy sources, which enhances one’s search engine rankings and credibility.

Additionally, leveraging partnerships can enhance your digital PR and blogger outreach efforts while avoiding toxic links and protecting your website from penalties.

We’ll delve deeper into these aspects.

Acquiring Quality Backlinks from Reputable Sources

Backlinks are links from other websites to your own. High-quality backlinks from reputable sources can significantly improve your search engine rankings and boost your credibility.

Acquiring such backlinks involves creating high-quality, link-worthy content and building relationships with your industry’s influencers and other reputable sources.

Leveraging Partnerships for Digital PR

Partnerships can significantly enhance your digital PR efforts. Collaborating with influencers, affiliate networks, and other businesses can increase your online exposure and reach a wider audience.

Avoiding Toxic Links

Toxic links are detrimental backlinks from subpar or irrelevant sources that can tarnish your website’s reputation and adversely affect your search engine rankings and organic traffic. Effective link-building strategies should include quality content and relevant, user-beneficial link placements.

Enhancing Content Marketing for Financial Services

Content marketing holds a pivotal place in your digital marketing strategy, especially your SEO strategy. Creating engaging and informative content can draw and retain a well-defined audience, driving profitable customer actions. To enhance your content marketing efforts, consider integrating long-tail keywords into your content and refreshing and repurposing existing content.

Let’s dig deeper into these strategies.

Developing Engaging and Informative Content

Creating engaging and informative content is pivotal in drawing and maintaining your audience. You should create high-quality content that:

- Is relevant and valuable

- Resonates with your audience

- Addresses their specific needs

- Improves engagement and conversion rates

Integrating Long Tail Keywords into Content

Long-tail keywords are specific phrases that potential customers will likely use when they’re closer to the point of purchase. Integrating these keywords into your content can pull highly targeted site traffic, enhancing conversion rates.

Refreshing and Repurposing Existing Content

Updating and repurposing existing content helps sustain relevance and boost search engine rankings. By revamping outdated information and repurposing content into different formats, you can extend the lifespan of your content and reach a wider audience.

Grammarly, one of the world’s leading editing platforms, focuses on generating organic traffic rather than using paid ads or manipulative SEO strategies. A strategic blog generates over 50% of its organic traffic, showing the importance of brand authority and trust. The company’s plan also includes updating existing blogs rather than only focusing on creating new content, showing that repurposing existing content works.

On-Page SEO Optimization for Financial Web Pages

On-page SEO entails optimizing individual web pages to achieve higher rankings and garner more pertinent traffic in search engines. Key on-page SEO elements include crafting compelling meta descriptions and titles, structuring content with headers and subheaders, and optimizing images.

Consider these essential elements.

Crafting Compelling Meta Descriptions and Titles

Meta descriptions and titles hold a significant role in enhancing click-through rates and search engine rankings. By crafting compelling and keyword-rich meta descriptions and titles, you can entice users to click on your link and improve your website’s visibility in search engine results.

Structuring Content with Headers and Subheaders

Headers and subheaders are crucial for content organization and improved readability. They help divide your content into logical sections, making it easier for readers to navigate and understand. Moreover, using keywords in your headers can also improve your SEO efforts.

Image Optimization and Alt Text Usage

Images hold a vital role in enriching user experience and boosting SEO. Optimizing your pictures involves:

- Ensuring they load quickly

- Using the right size and quality

- Using alt text to help search engines understand the content of your images

Does The Design of My Financial Services Website Impact SEO?

It Depends. You could have minor design issues that are only aesthetic or more severe issues from an underlying development issue. Having a comprehensive audit done on your site is the best way to determine what needs to be improved and what can be left as it is.

Page load errors, low speeds, or indexing errors, for example, can all impact your positioning on the search engine results pages. The best way to achieve your search engine ranking goals is to have an SEO audit from an SEO company with experience optimizing finance websites.

Getting Started

SEO for financial services is not just a buzzword but a critical strategy for gaining online visibility and success. From understanding the unique challenges of the financial niche to crafting a comprehensive search engine optimization strategy and measuring its success, every step plays a crucial role.

By implementing these financial services SEO strategies, financial institutions, financial advisors, and other financial industry professionals can tap into the power of search engine optimization, reach their target audience, and ultimately drive growth and profitability.