Effective mortgage marketing has never been more critical as interest rates remain high and home sales low. Mortgage lenders and brokers are experiencing a massive change in the industry—digital mortgages are ramping up, and the online world is not just a landscape to conquer but the very focus of industry leaders.

And for that, you need an updated, comprehensive marketing plan. As a marketing professional with an SEO company that has been going strong for a decade, I will share the critical elements of every modern mortgage marketing plan.

This article covers compliance, email marketing, search engine optimization (SEO), social media marketing, PPC campaigns, content creation, and performance tracking.

Let’s start from the beginning.

What is Mortgage Marketing?

Mortgage marketing refers to all the strategies you employ to generate leads for your mortgage business and convert them into clients. Given how competitive the mortgage industry is, keeping those clients is becoming increasingly important.

Compliance in Mortgage Marketing

Whatever their mortgage marketing strategy, mortgage brokers must comply with federal and state regulations. Otherwise, they risk legal issues, paying hefty penalties, and—worse—ruining their business by losing client trust.

Understanding Regulatory Requirements

The Consumer Financial Protection Bureau and the Federal Trade Commission are the central bodies enforcing mortgage marketing regulations.

Mortgage companies must follow regulations in all marketing materials, regardless of the medium (print, website, or social media posts). Here are the key regulations you need to keep in mind:

- RESPA (Real Estate Settlement Procedures Act) requires mortgage lenders, brokers, and servicers to disclose all information about real estate transactions fully and explicitly prohibits practices such as kickbacks.

- TILA (Truth in Lending Act)—Also known as Regulation Z, the TILA requires full disclosure of all charges.

- UDAAP (Unfair, Deceptive, or Abusive Acts or Practices)—This regulation prohibits deception and coercion from making unwanted purchases and misleading clients by omitting information or specific statements.

- Mortgage Acts and Practices Advertising Rule (MAP Rule)—Also known as Regulation N, the MAP rule prohibits deceptive claims in mortgage advertising and other commercial communications.

- GDPR (General Data Protection Regulation)—The EU’s GDPR controls data storage, privacy, and security, requiring mortgage professionals who handle sensitive personal data to comply with its rules.

- The Safeguards Rule – The FTC updated the rules for financial institutions, requiring them to have a comprehensive information security program.

Ensuring Transparent Communication

While mortgage marketers may focus on compliance for legal purposes, honest communication in your marketing materials is simply good business practice. The mortgage process is already stressful for most clients, so make it as straightforward as possible for them.

Keep the information on your mortgage offers clear, precise, and complete. And whatever you do, don’t force your clients to dive into the small print to understand your offer. That is a surefire way to lose them refinance time.

Data Privacy and Security

Your mortgage company collects and processes a lot of personal data, from bank statements to tax returns. And if you have a digital mortgage application system, you must provide your prospective clients with even more assurance.

Whether you’re working advertising in the US or the EU, you need to ensure you have a sound information security program to avoid penalties and maintain consumer trust and safety.

Between the GDPR, the Safeguards Rule, and the terrifying consequences of failing to protect sensitive data, your best bet is implementing administrative, technical, and physical safeguards.

Why Mortgage Marketing is Crucial

Financial services spend the third most on ads, 10.7% of all ad spending in the US. Mortgage businesses spent over a billion on ads alone in 2022, which barely scratches the surface of the industry’s marketing efforts.

In a competitive landscape like that, mortgage businesses do not have the luxury of taking marketing lightly — it is a prerequisite for growth.

Increases Loan Origination Significantly

90% of potential clients start their loan or mortgage search online. Another 47% read between three and five pieces of content before contacting a company representative.

Therefore, effective mortgage marketing strategies provide clients with everything in one place—reaching them at the beginning of their search, educating them on different mortgage offers, and encouraging them to apply through secure, online quote forms and contact your loan officers.

Builds and Enhances Brand Visibility

Potential customers won’t remember your brand unless it’s somehow different from the rest of the mortgage industry — based on values, unique propositions, and how you (consistently) engage with your customers.

Your digital marketing strategies will be useless unless you use your visibility to build trust. This will include encouraging and replying to reviews (positive and negative), sharing testimonials and success stories, and ensuring your commercial communications are unambiguous and honest, as the FTC would want them to be.

Fosters Long-term Customer Loyalty

Ongoing marketing efforts, including email campaigns, educational content, loyalty rewards, community building, referral marketing, and even direct mail, keep you top of mind for past clients.

One of the best marketing tools for this purpose is a Customer Relationship Management (CRM) system. A good CRM helps you analyze customer data to provide better services, whether we’re talking customer support or refinance recommendations.

Identifying the Target Audience

You can’t begin your mortgage marketing process without identifying and understanding your target audience. Methods for analyzing your target market include (but are not limited to):

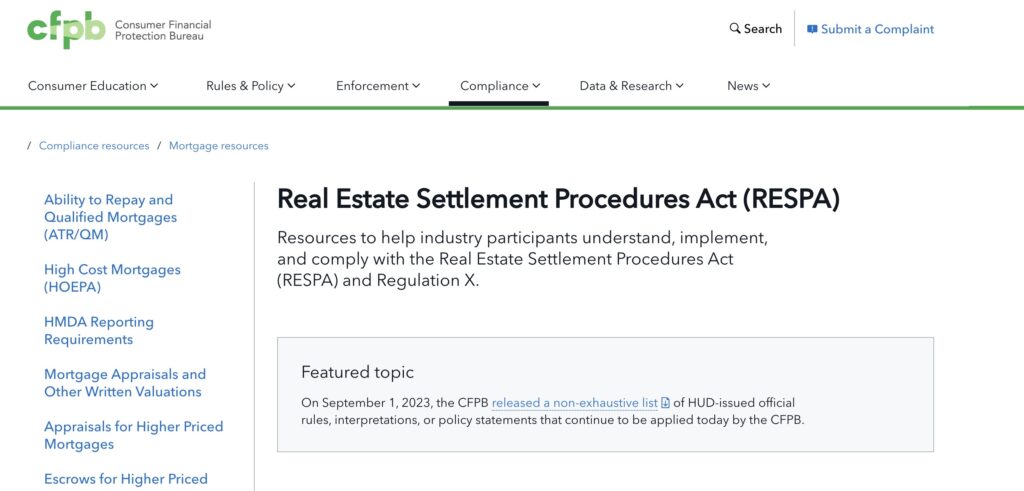

- Demographic analysis looks into age, income, marital status, or household size.

- Psychographic analysis looks into lifestyle or interests — think luxury buyers or investors.

- Competitor analysis looks into the target audience of your main competitors.

- Customer segmentation categorizes customers based on finances, life stage (first-time homebuyers or retirees looking to downsize), or other factors.

As someone who has worked (and still works) as part of mortgage marketing initiatives, I’ll tell you about a few standard target audience segments.

First-time Homebuyers Seeking Guidance

Here is how I would build a marketing approach for first time-homebuyers, depending on their needs and preferences:

- They are new to the home-buying process – Provide them with educational content on loan programs and financial literacy. Help them make an educated, confident decision.

- They often struggle with affordability, so your mortgage solutions must address their needs. They should also be educated on down payment assistance and closing costs programs. Provide mortgage and affordability calculators.

- Most of them are young. Work on mobile-friendly, digital solutions so you can meet them where they are.

Homeowners Considering Refinancing Options

Here are some ways to market to homeowners who might want a refinance:

- They want better rates – Provide them with content about lowering credit scores or choosing the most affordable mortgage solutions.

- They want to know it’s the right time – Educate them on industry trends and interest rates.

- They may be your past clients – Contact them through direct mail or email campaigns with beneficial offers. Send them promo materials with new mortgage loan terms.

Real Estate Investors Looking for Opportunities

Real estate investors are looking to earn money, and some are looking to purchase multiple investment properties, which makes them excellent potential customers.

Here’s how to attract them:

- They need specialized solutions – An investment property mortgage lender must have the right offers to attract investors, from qualification requirements to accepting LLCs as borrowers.

- They want proof. Share success stories from other investors, focusing on reviews and testimonials. Provide online tools for calculating ROI, yield, and other metrics.

- Researchers create content on industry news, market insights, innovative lending products, and real estate investing trends.

Real Estate Agents as Referral Partners

Real estate agents and mortgage loan officers both benefit from collaboration. For example, a pre-approval can help an agent find a property within their client’s budget.

However, it’s important to note that mortgage lenders or broker relationships with third parties, such as realtors, also fall within the abovementioned regulations. Hence, all parties need to study them closely.

That said, here are some strategies for building healthy agent-broker relationships:

- Share knowledge – Share valuable insights on industry trends and local developments to maintain your relationship,

- Communicate – Be available, as the agents must also serve their clients. Answer your emails and phone.

- Have a local presence – Real estate agents want to work with loan officers familiar with the local market. Focus on your area and start networking.

Financial Advisors and Planners

Financial advisors and planners are some of the best referral partners. They have their client’s best interests in mind and have a deep knowledge of their economic situation, so a referral from them is highly likely to convert.

Financial advisors need you in several situations. For example, a skilled mortgage loan officer can help advisors’ clients understand cash vs. mortgage, debt consolidation, and different refinancing scenarios.

Critical Components of a Successful Strategy

An effective marketing strategy must contain the following elements:

- Market research – Analyze your target audience, market trends, consumer insights, and competitors.

- Social media marketing – Social media is essential for increasing your reach, community involvement, and building relationships.

- SEO and lead generation – Gain visibility in organic and local search results to build awareness and attract leads.

- Content marketing – Create educational blogs, other written materials, and multimedia content.

- Email and direct mail marketing – Contact your leads with personalized letters and emails explaining your offer.

- Paid ads – Paid ads on social media, search engines, and offline channels.

- Brand identity – Articulate your unique value propositions, brand identity, and voice.

- Tracking performance – Build a data-based marketing strategy using tools like Google Analytics.

Deep Understanding of Your Audience

Proper market research will give you insights into gaps in the market — you will see what your competitors are missing, what to expect from the economy, and what the housing market looks like in your preferred area.

This will help you discover a target market, leading to my next point: customer personas. So, with further research, mortgage marketers discover similarities within each group, enough to craft a kind of character or persona (that is more straightforward to imagine and market to).

You have probably used customer personas before, even if not consciously. For example, you wouldn’t reach a real estate investor the same way you would a first-time homebuyer.

The people the persona is based on have similar needs, pain points (e.g., inability to borrow as a rental investor), goals (having multiple rental properties), and ways to market to this person.

Creation of Valuable, Engaging Content

Now that you know who you’re marketing to, you will know what troubles them about the mortgage process, their interests, and the kind of content you need to create for this person.

Address their pain points, offer solutions, and educate them on the process. Here are some examples:

- Content that educates them on mortgages you offer (that accept rental income)

- Content about strategies for purchasing multiple rental properties

- Content about investment property finances

Effective Use of Digital Marketing Channels

Digital marketing methods are as diverse as traditional mortgage marketing. They include email marketing, search engine optimization, social media, pay-per-click, video marketing, guides and ebooks, and online review management.

Since there are so many, don’t spread yourself (and your marketing budget) too thin. Implement an efficient workflow to see what you can handle in-house and what you need to outsource.

Also, marketing automation is your friend. Tools for email campaigns, social media marketing automation tools, content planning tools, and customer relationships management (CRM) software will save you not hours but months.

Social Media Platforms for Broader Reach

Using social media marketing, you can expand your reach and engage with prospective clients and referral partners. This is a (fundamental) overview of utilizing social media platforms to market your mortgage lending business:

- Choose the right platforms and adjust the messaging. If your target audience is middle-aged real estate investors, you are more likely to find them on Facebook and LinkedIn than on Instagram.

- Have a content strategy – Your social media campaigns need planning. Create a content calendar and mix your media – use videos, photos, and posts but provide value to customers (like with all other content).

- Social media advertising? Yes – Targeted ads on social media let you generate leads more precisely than any other media.

- Retarget potential clients—If someone interacts with your post or visits your page, they are already a potential client. Respond to their interest.

- Community building—It does sound like a buzzword, but you can use your prominence on social media to create or take part in groups that, for example, offer financial literacy education or provide value in other ways.

- Be present and engage. Like community building, social media is the place to reply to comments, collaborate with finance or real estate influencers, and ask questions.

- Use your brand voice – Social media writers and other professionals can help you find the perfect balance between casual and professional.

- Analytics tools – Platforms have tools that help you track and visualize your profile’s performance. Focus on reach, engagement, click-through, and conversion rate KPIs.

Email Marketing for Personalized Communication

Email marketing is one of the cheapest, most effective methods for marketing initiatives. With automation tools, you can send emails to thousands of subscribers with little time and financial effort.

However, don’t forget your GDPR and CAN-SPAM Act (the rules for commercial emails). Also, it lets people unsubscribe easily.

Robust and Consistent Brand Identity Development

While each marketing method requires its guide, consistent messaging is one rule of thumb you should follow for all of them.

With the help of marketing professionals, develop your brand voice and use it regardless of channel, working to ensure a seamless and uniform experience when switching between channels. Keep everything else consistent (but local to the channel), including visuals, general tone, and brand values.

SEO as a Cornerstone of Mortgage Marketing

Search engine optimization (SEO) is an umbrella term for various tactics that improve your position in the search engine results pages, increasing your traffic — the stats show that the top three organic search results receive 75.1% of clicks!

These tactics include (among other things) optimizing your website in technical ways, raising it in search engine results through improved user experience and commitment to content, and fine-tuning your digital marketing for the local market.

However, SEO can do more for mortgage brokers than reach and visibility. It supports critical elements of your mortgage marketing strategy, building authority, connecting you with other professionals in related industries, establishing trust, and encouraging engagement.

An SEO content marketing strategy also helps you educate your clients, increasing their confidence in their financial literacy or investment knowledge before they even start considering a mortgage.

And (pardon my professional enthusiasm) that barely scratches the surface.

Enhancing Online Visibility

SEO is indispensable for mortgage brokers as it helps them appear at the top of search engine results pages (SERPs). Effective SEO marketing strategies, such as keyword research, content creation and optimization, and optimizing websites speed, navigation, and user experience, raise your website to the top, making it easier for clients to find you.

Building Credibility and Trust

As a mortgage broker who helps people with (usually) the most significant financial decisions of their lives, you need to be established as an authority in your industry for potential clients to trust you.

High search engine rankings are an important first impression and increase your perceived trustworthiness and reputation.

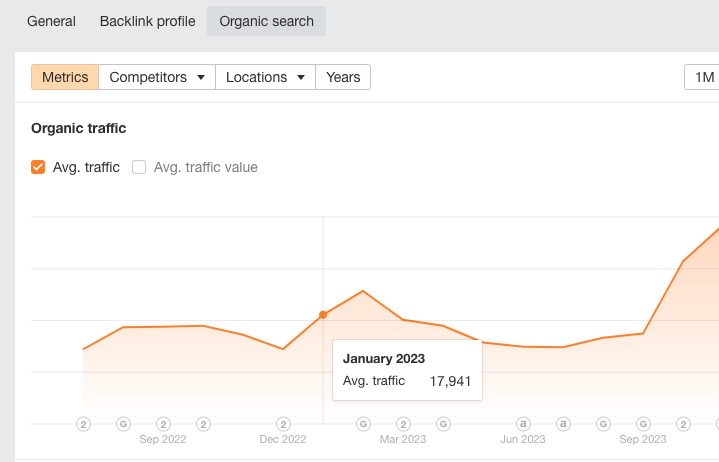

Driving Organic Traffic

Unlike paid advertising, which temporarily increases your visibility, organic (AKA inbound) traffic builds your online presence over time, attracting users who are already interested in mortgage services. As long as your website remains optimized, you will continue to attract visitors.

Finally, as it attracts more qualified leads, SEO is more cost-effective than traditional outbound methods. The average conversion rate for SEO is 14.6%, compared to 1.7% for outbound methods.

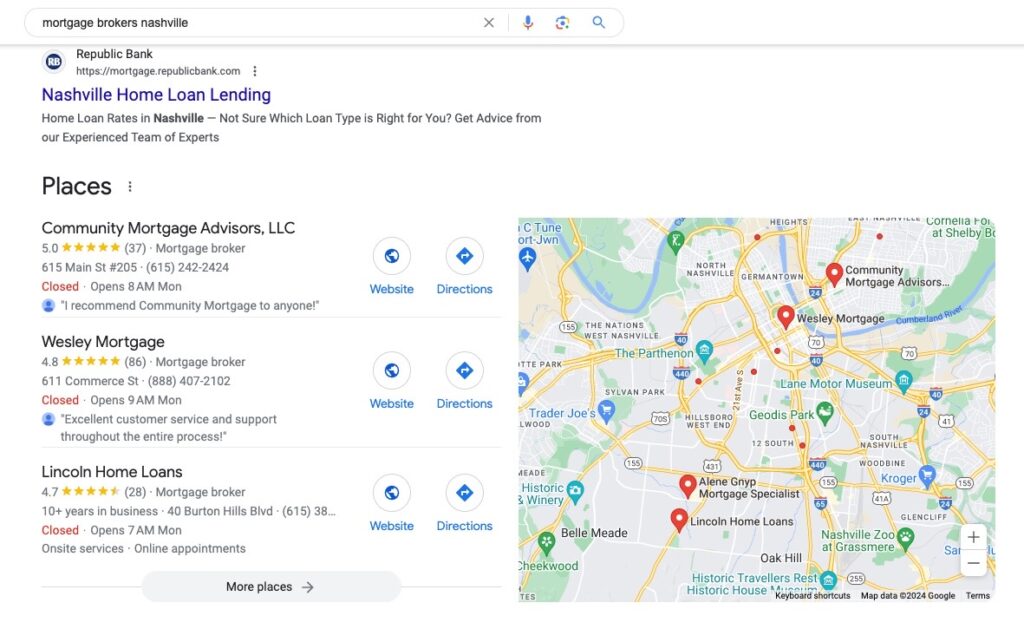

Targeting Local Markets

Mortgage brokers and lenders operating within local markets rely on local SEO tactics. Otherwise, they wouldn’t reach any customers online.

Local SEO includes optimizing your Google Business Profile, creating localized content, and improving your engagement with your local audience through online review management, events, and collaborations.

Last but not least, most clients look for a broker familiar with the local housing market. With local SEO, you become a part of the local community and showcase your market knowledge. At the same time, you remain high up in local search results.

Increasing Lead Generation

SEO is one of the best lead-generation strategies for one particular reason. As visitors search for terms related to mortgage lending on their own, your website receives a more targeted audience that is more likely to convert into paying clients.

You reach the people who want to read your content through SEO. They are an interested crowd who chose to hear what you offer. With advertising, you’re speaking to a crowd who may or may not be listening.

Improving User Experience

It takes a few seconds for a slow-loading, unoptimized website to frustrate visitors and make them leave. Even if you have an excellent offer, user experience issues will drive many potential customers away.

This is why one part of technical SEO focuses on improving site speed, navigation, and architecture to ensure a smooth visitor experience. From over a decade of industry experience, I can’t overstate the role of loading time and UX in rankings, conversion rates, and user engagement.

Staying Competitive

According to Forbes Insights, 45% of the mortgage industry’s marketing initiatives are already fully digital. And another quarter is digitizing their mortgage marketing strategies as we speak.

An effective SEO strategy is crucial for businesses to stay ahead of competitors as it addresses several marketing goals at once:

- Visibility

- Brand recognition

- Local presence

- Increasing industry authority

- Building credibility

- Lead generation

Long-term ROI

SEO marketing campaigns have a 275% ROI on average while maintaining long-term value. While a paid ad campaign may give you a temporary spike in traffic and conversions, it does very little for your business in the long run.

However, when you build a solid online presence that improves customer experience on multiple levels, the conversion rate and traffic grow steadily and naturally.

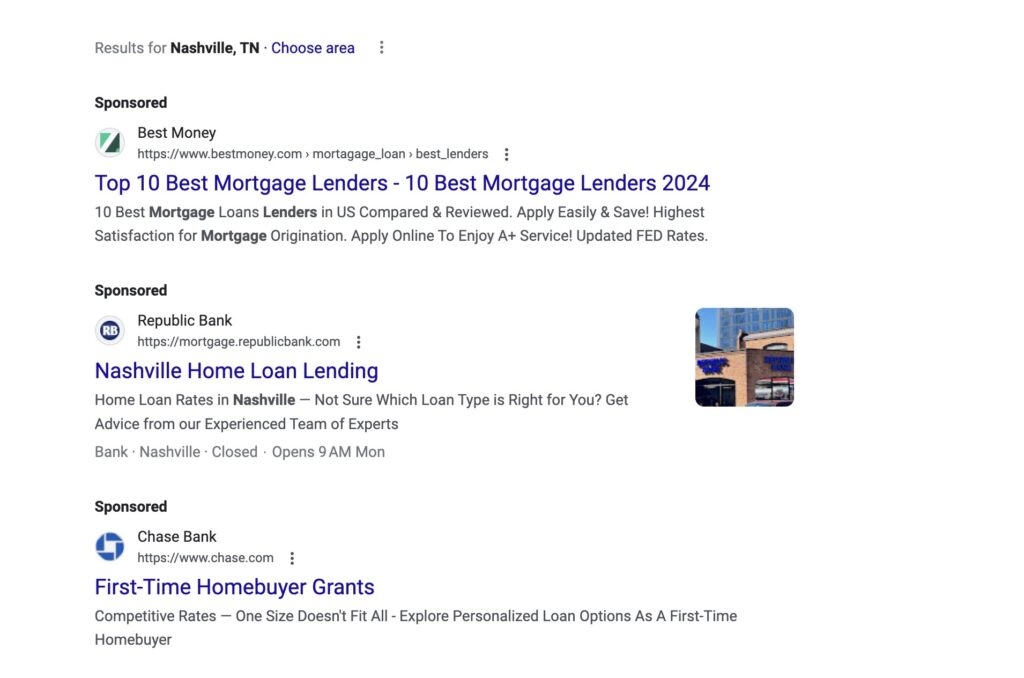

PPC Campaigns for Immediate Visibility

Although they may not be a long-term mortgage marketing tactic, pay-per-click campaigns can be valuable in reaching new audiences and boosting visibility.

In a way, they work like an auction. You choose the keywords you want to use in your campaign and try to outbid your competitors (this quickly gets expensive for popular terms).

Granted, they do not require as much time as SEO and give you complete control over who you target and what keywords you use. Another thing I like about them is they’re great for A/B testing your marketing strategies.

Here are some tips on PPC campaigns.

Crafting Effective Ad Copy

Crafting compelling ad copy is an art for which you will probably need a professional copywriter. It needs to be concise yet address customer frustrations and pain points while demonstrating how your mortgage works as a solution.

Also, you will need social proof — testimonials, success stories, reviews, or numbers. Finally, your ad copy must match your landing pages in brand voice, visuals, and other brand identity elements. This is just the tip of the iceberg, but you can see why a brief conversion-driving ad requires much work.

Optimizing Landing Pages for Conversion

Once visitors click on your ad, the page they land on must be worth it for both of you.

So, immediately give your visitors what they clicked for. Keep these pages brief, informative, and engaging. Long paragraphs? Leave them for educational content (if you must).

Optimize the page for the funnel stage you’re targeting, the action you expect (get a quote, contact a loan officer, calculate your mortgage payment), and the need you’re fulfilling (e.g., reassurance for people with low down payment funds).

You will also need to target highly relevant keywords, as your visitors use these in their searches. And don’t forget the design, especially for action elements like buttons.

Managing and Scaling PPC Campaigns

Like you manage your organic (unpaid) performance through SEO, you will adjust and measure your paid traffic performance through PPC KPIs.

You will adjust which KPIs to monitor based on your campaign’s goal: click-through rates, cost per click, conversion rates, cost per conversion, ROAS, ad quality, and AOV are some of the most crucial ones.

These KPIs are not entirely in your power — they may be affected by market trends, holiday seasons, and other outside factors. However, they will give you an excellent basis for A/B testing different marketing campaigns.

The answer to scaling is strategy: giving your consumer something of value throughout the funnel. In mortgage marketing, this will mean addressing the concerns and issues of each customer persona depending on when they land on your page.

Other strategies involve campaign upkeep, diverse ad copies and visuals, and high-quality mortgage content.

Creating Valuable Mortgage Content

Mortgages are a long-term commitment, risk, and opportunity, and potential clients usually spend a lot of time reading before they contact a mortgage broker.

Your guides, tools, videos, and infographics aim to educate, engage, and reassure your audience so they can make informed decisions.

Educational Blog Posts on Mortgage Basics

There are countless blog post topics for each of your buyer personas. For example, for your young first-time homebuyer, you can explain the types of mortgages, payment schedules, down payment assistance programs, basic mortgage terms, mortgage insurance, and government loan types.

For retirees looking to tap into their home equity after the kids have moved out, you can advise on reverse mortgages, home equity loans, housing market trends, and financial risks (such as tapping into retirement funds).

Comprehensive Home Buying Guides

Again, segment your target audience according to the home-buying scenario they’re interested in.

Regardless of the buyer persona, cover the entire process. Your guide outline for a first-time homebuyer, carefully segmented and organized through headings and subheadings, might look something like this:

- Finding a home

- Down payment assistance programs

- Government loans

- Choosing a mortgage lender

- Deciding on a mortgage type

- Mortgage terms

- What the loan application process looks like

- Making an offer

- Appraisals and inspections

- Understanding and paying closing costs

- Tax and legal considerations

Your guide can later branch out into other articles, explaining each concept in more detail.

Interactive Mortgage Calculators for Users

Interactive tools such as mortgage calculators benefit users by giving them personalized information about their potential monthly payments, interest rates, and other mortgage variables. They are a simple addition to your total customer experience, but they can set you apart from competitors and increase conversion rates.

At the same time, online tools boost organic traffic and engagement rates and might increase your reach through user sharing.

Video Content for Explaining Complex Topics

Video marketing has a critical advantage over written content. It keeps users more engaged, as it is easier to follow and requires less energy.

Videos would ideally be short, clear, and illustrative for complex topics such as mortgages, with animations, graphs, or client testimonials. Start with basic concepts and keep the jargon for another time.

You’ll likely need to organize these videos into series and post them on your website, FAQ section, social media, and video platforms. And don’t forget to include closed captions for accessibility and convenience.

Infographics for Quick Insights

While on the topic of simplifying complex issues, infographics are a powerful tool for doing just that. With a talented designer, you can break down market trends, interest rates, payments through time, and many other mortgage concepts.

Best of all, they’re versatile. You can use them in blog posts, videos, or as a visual aid in promotional materials and email campaigns.

Buying Shared Mortgage Leads: Drawbacks and Considerations

Many mortgage professionals with smaller businesses do not have the budget or the time for a comprehensive marketing strategy. This is why buying shared leads is such a common practice. However, even when you buy them, you still have to compete with other brokers for the lead — if the lead is any good.

Lower Lead Quality

Shared leads are likely barraged with calls from brokers, and if they entered their information on a site that sells the lead to many businesses, they may be overwhelmed.

Also, your leads don’t know you. They may feel more like a number than a potential valued customer, making them even less interested in your offer.

Increased Competition

The increased competition can be stressful for the potential customer and you or your sales team. It means more effort for a lower conversion rate,

Higher Costs in the Long Run

Buying leads occasionally won’t harm you, but it may not be sustainable in the long run. With organic or PPC leads, you get more targeting, interest, and exclusivity, increasing your chances of closing a deal.

With a targeted campaign, you build a relationship, and the client actively chooses to engage with your brand, increasing the chance that your services are a good fit for them. Bought leads may have less loyalty to the brand simply because, maybe, you’re not a good fit.

Lack of Personalization

The lead may have entered their contact data in exchange for access to a tool or content and expressed a general interest in mortgage products. As opposed to targeted campaigns or organic marketing, your foundation is already weaker, as you lack information about the lead’s needs, pain points, interests, or demographics.

Compliance and Privacy Concerns

Shared leads may come from companies that didn’t follow GDPR (or CCPA in California), which might also spell a legal issue for you.

You may also need to verify your lead providers’ consumer rights and data privacy practices. Lastly, to comply with data privacy regulations, you need to keep records of shared leads and have proof of consent.

SEO and PPC as Superior Alternatives

SEO and PPC generate more exclusive, targeted leads with higher conversion rates. They also allow you to target specific demographics and design mortgage marketing strategies more precisely.

In the long run, your mortgage company will benefit more from SEO and PPC than shared leads, letting you take control of your lead generation and pushing your business to grow.

Social Media Best Practices

Your social media marketing strategy will require you to deal with changing algorithms and market trends. However, some social media best practices never change, and by focusing on them, you can use engagement to promote your service, educate your audience, and build partnerships.

Regular, Meaningful Engagement with Followers

Social media is another opportunity to educate your clients, and I’m not saying you shouldn’t also do it here. However, your engagement with followers can also come in the form of more casual yet industry-specific content.

This is also the best place to interact with your followers. Respond to comments, host live streams, create polls, and encourage respectful discussions. Chatbots can also make a difference, as they provide your customers with 24/7 information.

Sharing Real Customer Success Stories

Success stories and testimonials will not only provide proof that your services have helped others. They also humanize your customers and help them feel you care about their success. If you can feature user-generated content, that’s even better.

Timely Updates on Mortgage Rates and Market Trends

As someone who has worked with content for years, I can confirm posting regularly doesn’t happen without a realistic content calendar. Keep your social media posts timely and consistent.

Also, as you learn more about market conditions and trends from experience (and industry reports), share your knowledge with your audience. While your usual goal may be to convert, focus on helping your audience here. That establishes you as a trusted source of information and advice.

Utilizing Paid Social Media Campaigns

Social media advertising lets you segment your target audience in a highly detailed way, so you can use carefully crafted messaging for different buyer personas in different marketing funnel stages (I repeat myself, but don’t forget to retarget people who have already engaged with your page).

Since it’s social media, you have even less time to make a statement—compelling ad copy, eye-catching visuals, and headings are non-negotiable.

Email Marketing Strategies

There are two main reasons to use email marketing campaigns: nurturing leads and keeping your current customers.

As part of mortgage marketing strategies, lead nurturing refers to supporting potential clients throughout their customer journey. Once they have already subscribed to your newsletter, you can send them personalized emails with educational content—but keep it consistent (not uniform) through multiple channels.

You can also use lead scoring tactics to determine what type of effort to put into each of your leads based on their social media post engagement or actions on your website.

When keeping your customers, you also need to keep track of their journey. For example, create trigger events in your CRM to know when someone might be ready for a refinance.

Your repeat customers have the highest lifetime customer value, so prioritize them regardless of strategy or channel.

Segmenting Lists for Targeted Messages

Email campaign automation tools help you create segmented lists easily and target your messaging for the best results, as with other marketing channels. Segments can include:

- Inactive clients

- New leads

- Buyer personas

- Location

Once you decide on your criteria, you need to work on creating content. After that, you can send your emails and start measuring the results (open rates, click-through rates, conversion rates, and unsubscribe rates).

Personalizing Content for Higher Engagement

You’ve already completed your first personalization goal if you’ve segmented your audiences. You probably won’t use all these techniques for all the segments, or you won’t use them in the same way. Still, here are some of the best personalization techniques:

- Trigger emails – Have they just completed an action, such as subscribing, asking for a quote, or completing pre-approval? That calls for a personalized email.

- Be less formal – Use more casual, direct, and personal language in your email marketing efforts.

- Anniversaries and events – Emails on financial health, holiday-themed mortgage emails, birthdays, or milestones in mortgage payments.

- Dynamic content – Email tech allows you to send real-time updates on rates or market trends.

Exclusive Insights and Offers for Subscribers

Nurturing leads requires offering something to your potential clients at every step of their customer journey. Email marketing is perfect for that—you can provide exclusive ebooks, checklists, and explainers on topics such as:

- Mortgage fundamentals

- Improving credit and financial health

- Home improvement content

- Homeownership

- Tax and legal considerations

And money is always a good motivator, so incentivize subscribing by offering exclusive deals.

Measuring Marketing Success

You won’t know what works if you don’t measure your mortgage marketing efforts. The key performance indicators in all these different channels will change depending on your current campaign, but there are some basics you have to know.

Website Traffic and User Engagement Analysis

My first recommendation is to get on first-name terms with Google Analytics. It can take a while since it covers a wild list of metrics, from traffic sources (email, direct, social media) to devices used and click-through rates.

And regarding user behavior, your GA4 Path exploration report will give you a clear image of what your users are doing on your website.

But regardless of the tool you use (and there are many, many analytics tools online), the gist of the process is the same:

- Measure

- Analyze

- Find pain points

- Optimize and adjust

- Rinse and repeat

Email Campaign Performance Metrics

Key performance indicators for your email campaign are:

- Click-through rate – This is your number one metric showing how many subscribers are interested and engaging with your campaign.

- Open rate – It’s great for measuring how well your emails are doing from week to week. Keep the subject lines compelling!

- Conversion rate – This is your primary lead generation metric, showing how people do what the email asks them.

- List growth rate: People unsubscribe, and lists shrink with time. This shows you how much you need to grow your subscriber list.

- Unsubscribe rate – It’s not the end of the world, and it will happen, but check it every few weeks.

Social Media Growth and Engagement Rates

Growth metrics show how popular your account is. Depending on the platform, they include page likes, followers, or subscribers.

On the other hand, we have engagement rates that measure how well your content is resonating with the audience (shares, retweets, comments, and post likes).

SEO Performance Metrics

SEO requires constant improvement, updates, and monitoring. These metrics should be your top priority:

- Organic traffic

- Click-through rates

- Backlinks (mind the quality and not just the number)

- Keyword rankings

- Bounce rate

- Domain authority

- Average time on page

- Technical and optimization metrics (broken links, internal links, page speed)

PPC Campaign ROI

Keyword bids can set your budget back significantly, and you must know if it’s worth it. Here’s how to calculate ROI on PPC campaigns:

- Subtract Total PPC Costs from Total PPC Revenue

- Divide the result by the Total PPC Costs

- Multiply this result by 100

Getting Started

The mortgage marketing landscape is evolving into a more digital ecosystem, and mortgage companies must adapt.

You need a comprehensive digital marketing plan that involves email, PPC, and social media, but you won’t get anywhere without a good foundation. The foundation is your website’s performance, for which you do need SEO.

Our mortgage broker SEO campaigns have been helping some top mortgage companies grow for years.

Contact Stellar SEO today and work with us to strengthen your relationship with potential clients and further boost your credibility in the mortgage industry.